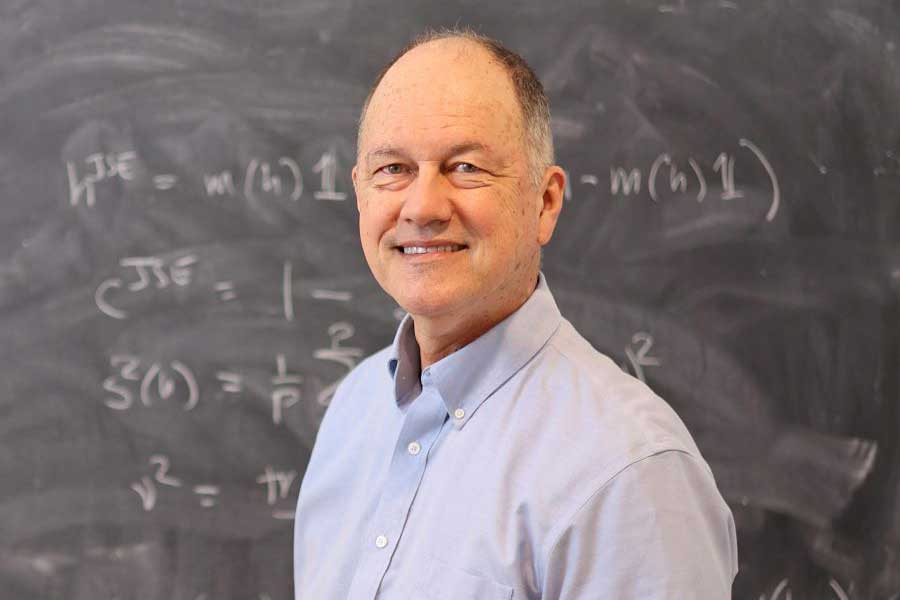

A professor in Florida State University’s Department of Mathematics has made a breakthrough that will allow scientists across academic disciplines and financial institutions to shrink sampling errors concerning high-dimensional financial data.

Professor of Mathematics Alec Kercheval and study co-author Lisa Goldberg, from the University of California Berkeley, developed a new statistical method that reduced estimation errors and improved performance measurements when a small number of observations are used to estimate large quantities of data — so-called high dimensional data.

The work, published in Proceedings of the National Academy of Sciences (PNAS), has significant implications for financial and risk management.

“Our original motivation was to study the risk of financial investment portfolios, which can involve estimated changes in returns on security investments,” Kercheval said. “Potential widespread applications of this work exist within artificial intelligence technology, including automated shape recognition, natural language processing, and genome-wide association studies.”

While a financial analyst can observe monthly price changes for each of the 3,000 stocks in the Russell 3000 Index (or any financial index) over a period of a few years, price changes occurring too far in the past are no longer relevant to future results. For this reason, the observed history is usually limited to two or three years of monthly returns, meaning the number of data points is far fewer than the total number of correlations that need to be estimated among the 3,000 stocks.

Kercheval’s research provides a way for the analyst to better estimate the future risk of proposed stock portfolios by reducing statistical uncertainties, and this new method is most useful to financial portfolio managers who often run into challenges when determining financial outcomes for their clients when the number of assets held in a single portfolio exceeds the manager’s possible observations.

The methods, however, can be applied to any setting where researchers need to understand correlations among many variables.

Kercheval, who has worked at FSU since 2001, specializes in financial mathematics, mathematical economics, dynamical systems, and geometric analysis, and his most recent work contributes to decreasing risks in financial investment portfolios. He is also an affiliated researcher at the University of California Berkeley’s Consortium for Data Analytics in Risk.

The research team relied on earlier concepts from Charles Stein, a 1950s statistician who launched a new era of statistics with his James–Stein, or JS, shrinkage estimator. The JS shrinkage estimator was developed to help mathematicians lower the margin of error among three or more combined averages of data by shrinking them toward their collective average.

Stein’s ideas on average shrinkage can be applied in a new way to understand the most important directions of variation in data. This is valuable for scientists and financial institutions attempting to limit error in their average estimations of data for the populations they serve.

“Publishing this work in PNAS boosts the visibility of new ideas toward financial risk management and minimizing sampling error, which attracts attention across disciplines that is accelerating progress toward a better understanding of high-dimensional data,” Kercheval said.

Before coming to FSU, Kercheval spent the early part of his career as an assistant professor of mathematics at Boston University and the University of Texas at Austin, then as a senior research consultant for Morgan Stanley Capital International-Barra, Inc. He earned a master’s degree from University of Oxford, U.K., in 1982 and his doctorate in mathematics from the University of California Berkeley in 1987. Kercheval has authored more than 40 publications and a book on financial mathematics.

“Alec has contributed to the department and university in multiple ways through his research, teaching and service. He has championed quality basic mathematics instruction at FSU through many years of hard work and dedication,” said Washington Mio, Department of Mathematics chair. “This has most positively impacted the learning experiences of thousands of FSU students.”

This research was conducted in collaboration with UC Berkeley Professor of the Practice of Economics Lisa Goldberg, who also serves as managing director and head of research at Aperio by BlackRock, an investment management company.