As college students across the nation consider taking out loans as they head back to campus for another school year, Florida State University has set its sights on becoming the best public research university in the country for graduating students with little or no debt.

President Richard McCullough said it’s an audacious goal but an attainable one.

FSU is already among the Top 12 public research universities when it comes to low student debt, he said, and the university could be No. 1 in the next couple of years.

“I think it’s really important that we not only deliver an amazing education to our students, but we also do it in a way that’s the lowest cost,” said McCullough, noting that FSU has one of the lowest tuitions in the country.

He said that when students graduate with debt, “it makes it harder to get your life started. That’s the last thing we want to saddle our students with and burden them with.”

Helping to spearhead the university’s multifaceted strategy to support students’ financial wellness is Associate Provost and Dean of Undergraduate Studies Joe O’Shea.

“We want to graduate our students with the lowest debt possible among public research universities in this country,” O’Shea said. “It’s a goal we’re already very close to achieving.”

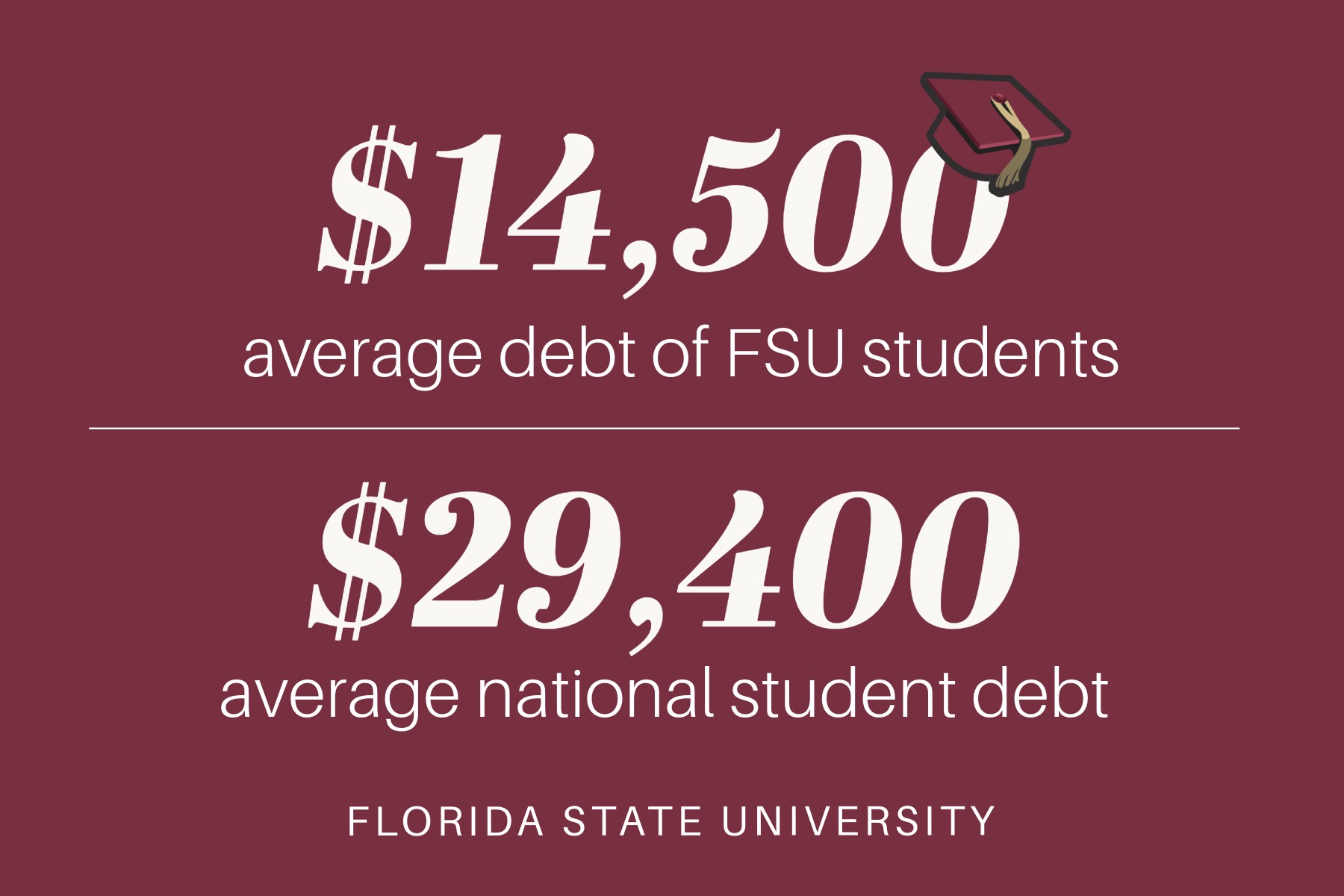

Currently, about 32% of FSU undergraduates graduate with some debt, with an average of $14,500 — a figure that has been decreasing each year. This puts FSU well below the national average of $29,400 in student loan debt at graduation.

O’Shea said that while student loans can play an important role in financing education, FSU is focused on preventing excessive debt that could negatively impact students’ futures.

“We are committed to doing everything possible to make sure our students thrive during their time at FSU and can launch successfully when they graduate,” he said. “Part of that commitment is their financial wellness and ensuring they have the resources they need to continue at FSU and engage fully in their education.”

In fact, 86.3% of full-time undergraduates received some form of non-loan student financial aid during the 2022-2023 academic year.

Florida has among the lowest public university tuition in the country, making FSU among the most affordable in the country for a world-class educational experience, according to O’Shea. Florida State has not raised the price of tuition for the past 11 years.

“This is part of FSU’s commitment to making sure our education is as accessible as possible,” he said.

FSU students graduate on time, which helps minimize debt by reducing the time students spend accumulating expenses. The university has one of the highest four-year graduation rates in the country — 75% of FSU’s students graduate in four years.

“Our students are not staying for five or six years and accumulating debt. Our focus on timely graduation is a key part of our strategy,” O’Shea said.

FSU’s efforts to minimize student debt are rooted in a strategy that includes financial education, increased scholarship funding and innovative support programs. O’Shea highlighted several key components of the approach:

Expanded scholarships and grants

Through the support of alumni, donors and legislative backing, FSU has significantly increased the amount of scholarship dollars available to students. FSU distributed more than $105 million in scholarships last year.

“We’ve been able to bring the average debt levels down incrementally for each graduating class,” O’Shea said. “This is thanks to the incredible generosity of our donors and the strong institutional and legislative support.”

Notable examples include significant gifts for first-generation students, women in STEM and other scholarship programs.

“It really is such a beautiful approach in which so many people who care about FSU and about students are coming together to make sure that our students have what they need to thrive during their time in college and beyond,” O’Shea said.

Financial literacy education

Recognizing the importance of financial education, FSU has launched initiatives such as the Unconquered by Debt Program. This program, led by Joe Calhoun, director of FSU’s Stavros Center for Economic Education, provides outreach and peer education to help students understand finances, student loans, credit, budgeting and long-term financial planning.

Targeted support for vulnerable students

Programs like CARE, or the Center for Academic Retention and Enhancement, offer scholarships and holistic support for first-generation and Pell-eligible students. Recently, FSU introduced the Quest Scholars and Illuminate programs, which provide annual scholarships and $2,000 enrichment funds to support experiential learning opportunities like study abroad and internships.

Paid internships and work opportunities

Programs like InternFSU and InternFSU:TLH partner with university departments and local businesses to provide paid internships. The university also employs hundreds of students in roles like peer mentors and learning assistants.

Reducing textbook costs

University Libraries has adopted free open educational resources to reduce the financial burden of textbooks.

Retention and persistence grants

To ensure students can continue their education without interruption, FSU has established funds to support students facing financial challenges.

“We’ve been able to help hundreds of students stay at FSU when they were facing the choice of not continuing due to financial difficulties,” O’Shea said.

O’Shea noted that while recent federal complications disrupted this year’s financial aid process, FSU remains committed to its long-term goals.

“We’re in it for the long game,” he said. “This will forever be important.”

The success of these initiatives is heavily reliant on the contributions of FSU’s community of donors and legislative allies, O’Shea said.

“With continued partnership and support, we can achieve this goal and ensure that our graduates can launch their careers with as little debt as possible,” he said.

While the full impact of these initiatives may take years to fully materialize in the data, O’Shea said FSU is committed to continually improving its support for students’ financial well-being.

“The return on an FSU education is far more than just financial,” O’Shea said. “We are empowering our students to excel across all their roles — as employees, neighbors, citizens and friends. Our communities depend on the kind of educational experience we provide.”